The Small Consultancies Guide to IR35 - 3 essential steps to maximise value

How contractors can grow a small consultancy and adhere to IR35 compliance to maximise the sale value.

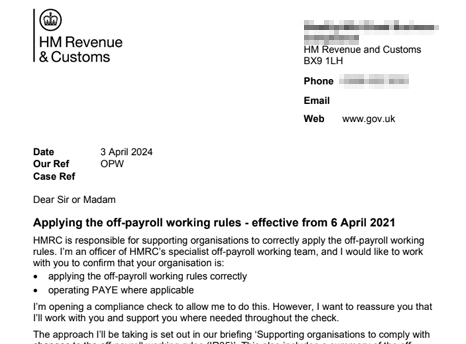

HMRC compliance checks are slow, stressful and very costly. Let our team handle it and use their expertise to guide you to a quick, stress-free resolution.

IR35 status

assessments

years' IR35

experience

The UK's first

IR35 status tool

over

IR35 Status Assessments

and counting...

“There was a lot of pressure throughout the compliance check, like one wrong step and it could all go wrong. However, IR35 Shield briefed us on how things may develop, which enabled the business to prepare for potential events. It felt as if HMRC were fault-finding, not fact-finding, so being forewarned really helped us.”

Chief Talent Officer - Adaptive

Even for fully compliant businesses, HMRC checks can be time-consuming and costly. IR35 investigations demand expert handling - not generalist approaches. With our specialist defence team, you'll ensure a swift, efficient response, minimising stress and protecting your interests throughout the process.

An HMRC compliance check is daunting, and if handled incorrectly can quickly escalate. Our expert team rely on real-world experience to handle every investigation the right way.

We aim to shut down your enquiry before it damages your business.

Extensive experience successfully defending enquiries at both enquiry and tax tribunal, our investigations team utilise their knowledge and expertise to help successfully defend status for clients.

Dave Chaplin is the UK's leading IR35 authority. He regularly provides consultancy on IR35 matters, helps successfully defend disputes at enquiry and tax tribunal, has authored two books on IR35 / off-payroll, and pioneered the first online IR35 status assessment over 10 years ago.

Chris Leslie has over 30 years’ proven experience defending clients in disputes with HMRC. His years managing Status Inspectors at HMRC, combined with his specialist qualifications in analytics, give him an in-depth understanding of how to counter the arguments used by HMRC.

Dave and Chris’ in-depth knowledge of IR35 and off-payroll combines to provide expert defence and guidance for your business. For help with an IR35 audit or compliance check please get in touch with our team.

In recent years dealing with IR35 and off-payroll enquiries has become highly specialised work. Success now depends on a comprehensive knowledge of the relevant statute and evolving case law, together with extensive experience of HMRC enquiry and tax tribunal work. With our success in tax tribunals against accomplished HMRC Counsel, you can be confident you've hired the right team.

During the enquiry stage, the team work to help establish the facts and grounds of appeal, designed to maximise the chances of obtaining early closure of the enquiry.

A solid foundation is laid at this stage should the matter have to be brought into appeal proceedings.

Leading up to tribunal, the team spend months intensively preparing and dealing with all detailed directions culminating in skeleton arguments.

During tribunal, our experience enables us to identify and convey to the court the substance of the dispute and why an appeal should be allowed.

The team successfully defended IT Contractor Richard Alcock at First-tier Tribunal, which defeated two barristers representing HMRC Solicitor’s Office. Chris and Dave worked together for 18 months to build the case defence before defending during a four day hearing. They succeeded in countering HMRC’s IR35 Opinion and extended time assessments with the Judge upholding RALC’s appeals.

When a long-time client of IR35 Shield received notice of an IR35 investigation by HMRC, the company turned to IR35 Shield's compliance experts for representation. Within months, the investigation was closed with no tax bill.

Dave and Chris are currently managing a range of IR35 enquiries and also offer consulting for businesses to help ensure their procedures and processes achieve defendable positions in light of the new off-payroll working legislation.

Don't just take it from us, listen to why our satisfied customers recommend our IR35 defence service.

“There was a lot of pressure throughout the compliance check, like one wrong step and it could all go wrong. However, IR35 Shield briefed us on how things may develop, which enabled the business to prepare for potential events. It felt as if HMRC were fault-finding, not fact-finding, so being forewarned really helped us.”

Marie Downes

Chief Talent Officer

“Knowing that you have experienced, industry-leading experts on hand to help navigate interactions with HMRC provides our business with significant peace of mind.”

Mike Bobroff

Central Ops and Change Director

We keep our finger on the pulse of IR35. You can trust our advice and guidance is always up to date.

The off-payroll rules apply only to contracts where either the client is a UK tax resident or the work is carried out in the UK...

Read the answer in detailThe IR35 reforms that came into effect in April 2021 do not affect small companies. Nonetheless, some small companies...

Read the answer in detailIR35 status assessments delivered to our customers. And counting.

The average recommendation score from our customers.

The year we built and released the UK's first IR35 status tool.

Definitive IR35 status results. Inside or outside IR35, no indeterminates.

Over 20 years of experience at the cutting-edge of IR35.

Defence cost cover available with our Tax Investigation Service.