The Small Consultancies Guide to IR35 - 3 essential steps to maximise value

How contractors can grow a small consultancy and adhere to IR35 compliance to maximise the sale value.

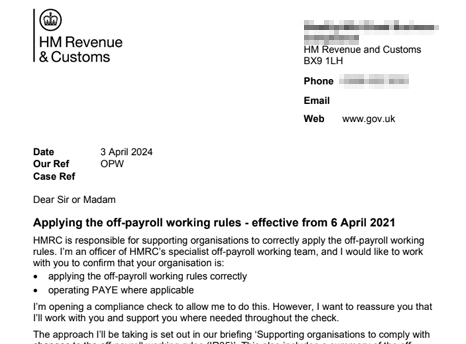

You have already undergone an HMRC off-payroll Compliance Check resulting in Regulation 80 Determinations and/or Section 8 Decisions being issued. You are facing a large tax bill with additional interest and potential penalties. You now need IR35 Shield’s expert defence team to step in and robustly defend your position, limit exposure, and manage resolution professionally and efficiently, without the need for tax tribunal.

Get in touch to find out how we can help.

You may have taken other advice or sought to defend your position in-house, but HMRC has not agreed with your position. It could be any or all of the following:

Whatever the scenario, providing robust representations to HMRC of a tribunal-level standard and taking a strategic approach can make a substantial difference to the outcome. Our goal is to protect your business, reduce exposure, and achieve a fair and efficient resolution.

Facing HMRC can be daunting but with IR35 Shield, you’re in safe hands. We have extensive experience dealing with HMRC on status matters in multi-million pound cases at both enquiry stage and tax tribunal.

Our expert defence team will:

Our involvement provides peace of mind that your case is being managed robustly, professionally, and strategically..

Status Assessments |Contracts |Audits |Training |Defence

Speak with an expert

We recognise that every case is unique, and professional fees should be invested in line with the level of financial and reputational risk involved. While some engagements may be arguable as “Outside IR35” at a tax tribunal, there are times when it is commercially sensible to settle.

IR35 Shield will help you strike the right balance between robust defence and practical resolution.

Extensive experience successfully defending enquiries at both enquiry and tax tribunal, our investigations team utilise their knowledge and expertise to help successfully defend status for clients.

Dave Chaplin is the UK's leading IR35 authority. He regularly provides consultancy on IR35 matters, helps successfully defend disputes at enquiry and tax tribunal, has authored two books on IR35 / off-payroll, and pioneered the first online IR35 status assessment over 10 years ago.

Chris Leslie has over 30 years’ proven experience defending clients in disputes with HMRC. His years managing Status Inspectors at HMRC, combined with his specialist qualifications in analytics, give him an in-depth understanding of how to counter the arguments used by HMRC.

Dave and Chris’ in-depth knowledge of IR35 and off-payroll combines to provide expert defence and guidance for your business. For help with an IR35 audit or compliance check please get in touch with our team.

We keep our finger on the pulse of IR35. You can trust our advice and guidance is always up to date.

The off-payroll rules apply only to contracts where either the client is a UK tax resident or the work is carried out in the UK...

Read the answer in detailThe IR35 reforms that came into effect in April 2021 do not affect small companies. Nonetheless, some small companies...

Read the answer in detail